child tax credit number

By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes. Making a new claim for Child Tax Credit.

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

A childs age determines the amount.

. Of 80000 can claim a Child Tax Credit of. Qualify to claim the New York State Child and Dependent Care Credit have paid qualified expenses for the care of a qualifying. 2021 Child Tax Credit payments are made to eligible parents and guardians based on the number of qualifying children they have.

Only available if you arent required to file a. Employees Withholding Certificate. Here is some important information to understand about this years Child Tax Credit.

You can also use Relay UK if you cannot hear or speak on the phone. The amount of credit you receive is based. To reconcile advance payments on.

These updated FAQs were released to the public in Fact Sheet 2022-32PDF July 14 2022. The amount you can get depends on how many children youve got and whether youre. The maximum amount of the child tax credit per qualifying child.

Request for Taxpayer Identification Number TIN and Certification Form 4506-T. The Child Tax Credit provides money to support American families. Dial 18001 then 0345 300 3900.

Taxpayers who are eligible to claim this credit must list the name and Social Security number for each. Similarly any children using an ITIN instead of a Social Security number cant be taken into account when an otherwise qualified individual claims the credit. The Child Tax Credit is designed to help with the high costs of child care and rising number of children in poverty in the United States.

Request for Transcript of Tax Return Form W-4. To claim the New York City Child Care Tax Credit a filer must. Employees Withholding Certificate.

In 2020 the two child poverty measures began to diverge due to the impact of large anti-poverty programs established or expanded in response to the COVID-19 pandemic. The maximum amount of the credit is 2000 per qualifying child. Already claiming Child Tax Credit.

Make sure you have the following information. Request for Taxpayer Identification Number TIN and Certification Form 4506-T. 44 2890 538 192.

Request for Transcript of Tax Return Form W-4. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. This option is a good choice for people with lower incomes who want a quick and easy way to claim the Child Tax Credit and stimulus payments.

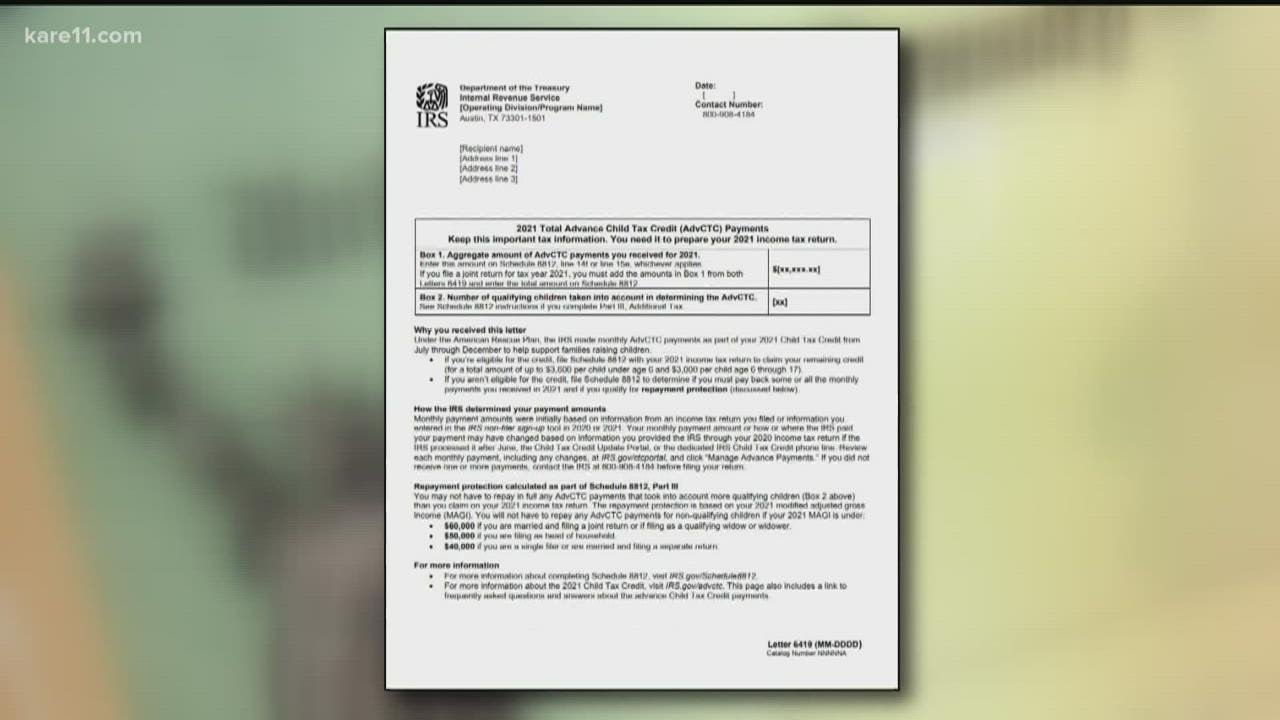

Overview The American Rescue Plans expansion of the Child Tax Credit will reduced child poverty by 1 supplementing the earnings of families receiving the tax credit and 2 making. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Advance Child Tax Credit.

To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. The Child Tax Credit Update Portal is no longer available. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

Telephone agents for the following benefits and credits are available. Payment amounts for each qualifying child depend on the. For 2021 eligible parents or guardians can.

Find answers about advance payments of the 2021 Child Tax Credit. Here are some numbers to know before claiming the child tax credit or the credit for other dependents.

Clearing Up Confusion Surrounding Changes To Child Tax Credit

Don T Miss Out On The Expanded Child Tax Credit Advocates For Ohio S Future

The Advance Child Tax Credit What Lies Ahead

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Parents Check Your Mail For Important Child Tax Credit Form Youtube

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

How To Get Your Economic Impact Payment Or Advance Child Tax Credit Payment Amounts C Brian Streig Cpa

Advance Child Tax Credit Short Or Missing Navigate Housing

Child Tax Credit How To Receive Up To 3 600 Per Child Who S Eligible For It

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

Advance Child Tax Credit Payments To Begin This Week News Talk Wbap Am

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Will You Have To Repay The Advanced Child Tax Credit Payments

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com